Investigating and employing tax strategies, from tax deferral to confirming a client's tax bracket, can play an important role in implementing tailored solutions and the overall success of a retirement strategy. We can support you with insight about taxes and tax-deferred products.

The power of tax deferral

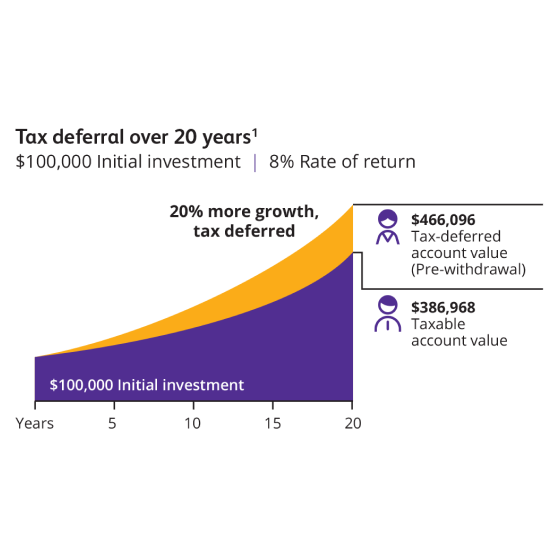

Taxes can have a big impact on long-term investment returns. Most investments in non-qualified accounts will be taxed on dividends, interest, and realized short-term and long-term capital gains. By utilizing tax deferral, clients can delay taxes on accumulated earnings until they are withdrawn, helping them accumulate wealth faster.

One solution for tax deferred growth potential

Introduce clients to tax deferred growth potential with Protective Dimensions V variable annuity. Learn more about how you can help clients optimize growth, create a legacy and deliver guaranteed lifetime income with this one product.

Other related topics

Why guaranteed income can help support your clients' retirement confidence

Important risks to consider in retirement planning

Key decisions in retirement planning

We’re here for you

We’re ready to help you deliver the protection and security your clients deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

1Assumes a 19.5% effective tax rate and standard deduction for filing jointly.

The tax treatment of annuities is subject to change. Neither Protective Life Insurance Company (PLICO) or its representatives offer legal or tax advice. Please consult with your attorney or tax advisor regarding your individual situation before making any tax-related decisions.

Protective refers to Protective Life Insurance Company (PLICO), Nashville, TN, and its affiliates. Variable products distributed by Investment Distributors, Inc. (IDI), Birmingham, AL, a broker-dealer and principal underwriter of registered products issued by PLICO, its affiliate.

Protective is a registered trademark of PLICO. The Protective trademarks, logos, and service marks are property of PLICO and are protected by copyright, trademark, and/or other proprietary rights and laws.

Protective Dimensions V variable annuity is a flexible premium deferred variable and fixed annuity contract issued by PLICO in all states except New York on policy form VDA-P-2006. SecurePay Income benefits issued on rider form VDA-P-6068. Product availability and features may vary by state.

Variable annuities are long-term investments intended for retirement planning and involve market risk and the possible loss of principal. Investments in variable annuities are subject to fees and charges from the insurance company and the investment manager.

Investors should carefully consider the investment objectives, risks, charges and expenses of a variable annuity, any optional protected lifetime income benefit, and the underlying investment options before investing. This and other information is contained in the prospectuses for a variable annuity and its underlying investment options. Investors should read the prospectuses carefully before investing. Prospectuses may be obtained by contacting PLICO at 800-456-6330.

WEB.3143639.11.22

The tax treatment of annuities is subject to change. Neither Protective Life Insurance Company (PLICO) or its representatives offer legal or tax advice. Please consult with your attorney or tax advisor regarding your individual situation before making any tax-related decisions.

Protective refers to Protective Life Insurance Company (PLICO), Nashville, TN, and its affiliates. Variable products distributed by Investment Distributors, Inc. (IDI), Birmingham, AL, a broker-dealer and principal underwriter of registered products issued by PLICO, its affiliate.

Protective is a registered trademark of PLICO. The Protective trademarks, logos, and service marks are property of PLICO and are protected by copyright, trademark, and/or other proprietary rights and laws.

Protective Dimensions V variable annuity is a flexible premium deferred variable and fixed annuity contract issued by PLICO in all states except New York on policy form VDA-P-2006. SecurePay Income benefits issued on rider form VDA-P-6068. Product availability and features may vary by state.

Variable annuities are long-term investments intended for retirement planning and involve market risk and the possible loss of principal. Investments in variable annuities are subject to fees and charges from the insurance company and the investment manager.

Investors should carefully consider the investment objectives, risks, charges and expenses of a variable annuity, any optional protected lifetime income benefit, and the underlying investment options before investing. This and other information is contained in the prospectuses for a variable annuity and its underlying investment options. Investors should read the prospectuses carefully before investing. Prospectuses may be obtained by contacting PLICO at 800-456-6330.

WEB.3143639.11.22

To exercise your privacy choices,

To exercise your privacy choices,