Retirement planning basics

Working with clients on a cohesive retirement strategy is a smoother process when you are fully prepared to speak to all the options. Our resources can help clarify the role of annuities and facilitate productive conversations.

Top 3 retirement planning benefits offered by annuities

If your clients aren't familiar with utilizing annuities as part of a long-term retirement strategy, it can help to introduce them in terms of the key benefits they offer. You can easily turn these key retirement benefits into talking points:

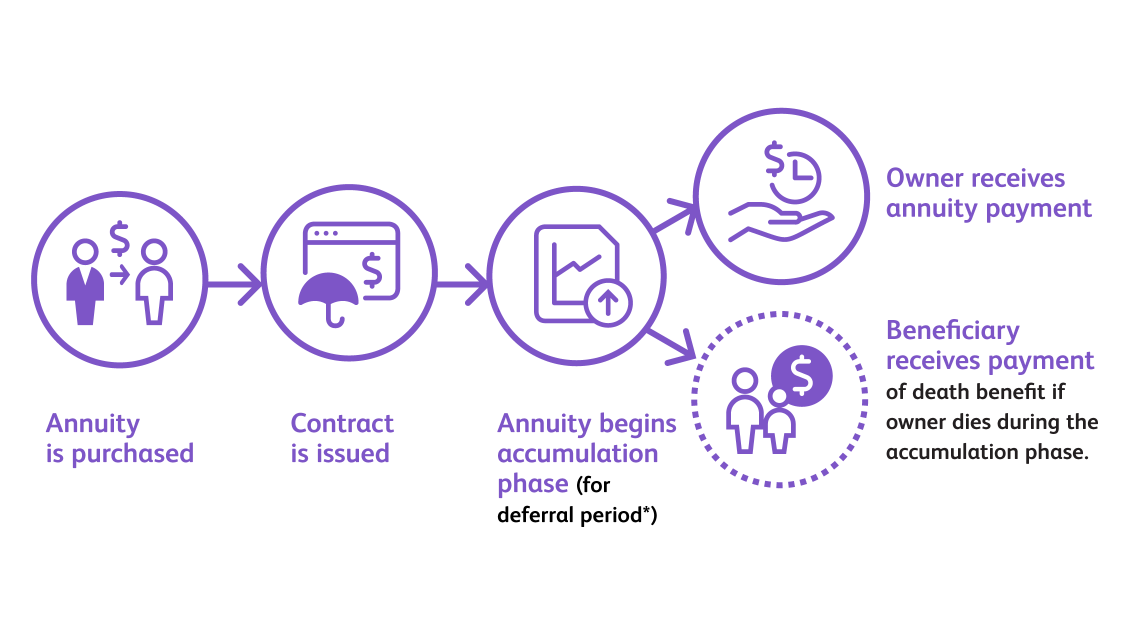

Explaining the 2 phases of annuities

Basic annuity designs: immediate or deferred?

There are two types of high-level annuity designs to consider, depending on client needs, retirement goals and retirement timing.

Explore the different types of annuities

We offer different types of annuities to better meet the various needs of your clients. Many of our annuities include enhanced income features, competitive fees and expanded investment options.

Compare features for the ideal fit

Use this chart to help determine which type of annuity best meets your clients’ retirement needs.

Tax-deferred growth

Death benefit

Options for single-payment purchase or installments

Minimum guaranteed interest rate

Principal protection

Investment options

Market investments

Fixed annuity

Variable annuity

Other related topics

Developing a holistic retirement strategy

Key decisions in retirement planning

Understanding the basics of life insurance

We’re here for you

We’re ready to help you deliver the protection and security your clients deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

*An immediate annuity will not have an accumulation phase

Annuities are long-term insurance contracts intended for retirement planning. Annuities also may be subject to income tax and, if taken prior to age 59 ½, an additional 10% IRS tax penalty may apply. Because Protective and its representatives do not offer legal or tax advice, it is important that you talk with your own legal and tax advisor about your specific tax situation.

Investors should carefully consider the investment objectives, risks, charges and expenses of a variable annuity and the underlying investment options before investing. This and other information is contained in the prospectuses for a variable annuity and its underlying investment options. Prospectuses may be obtained by contacting PLICO at 800.265.1545.

WEB.3072026.09.21

To exercise your privacy choices,

To exercise your privacy choices,