Boost retirement confidence with guaranteed income

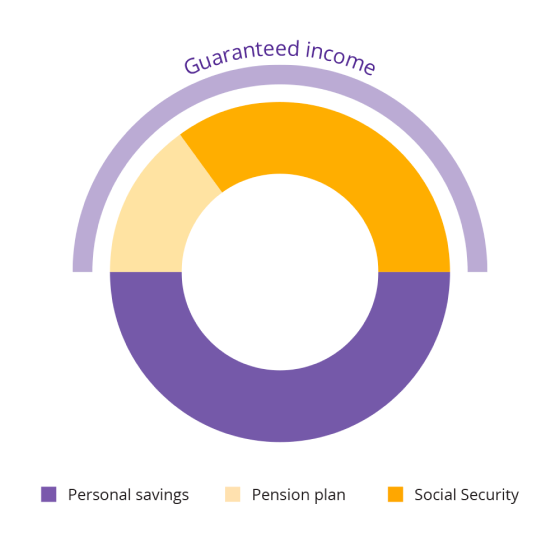

Clients can feel more confident in the future they've worked hard for when a portion of retirement income is derived from guaranteed sources. Start a guaranteed income conversation with your clients and help them protect their vision for retirement.

3 benefits of guaranteed income for clients

Build more confidence with a guaranteed income solution

Guaranteed income solutions, like annuities, can help clients feel more confident in the long-term viability of their retirement plan. See how leveraging an annuity can protect retirement income and secure funding for inflexible retirement expenses.

Use this 3-step income planning approach with clients

Employ three easy tactics to strengthen your client's confidence in their retirement plans. Set spending priorities, estimate expenses, and evaluate how flexible their expenses can be. For more on this approach and support to enrich your client conversations, download this white paper by expert Michael Finke.

Explore our guaranteed income solutions

When you've identified a need for guaranteed income in your clients' plans, our suite of annuity solutions can help you deliver a solution that best fits your clients' retirement goals. Explore our options below.

Income soon

Protective® Income Creator Fixed Annuity

Fixed annuity

Protected lifetime income with access to money

Income with legacy

Protective® Dimensions V Variable Annuity

Variable annuity

Tax-deferred growth plus an optional lifetime income benefit

Other related topics

Important income risks to consider in retirement planning

Risks to consider when accumulating retirement savings

Stress test a client's income plan with a portfolio reliance rate review

We’re here for you

We’re ready to help you deliver the protection and security your clients deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

1David Blanchett and Michael Finke, "Guaranteed Income: A License to Spend," 2021.

Protective Income Creator fixed annuity is a fixed, single premium, deferred annuity contract with a limited market value adjustment issued under contract form series LDA-P-2013 and state variations thereof. The Lifetime Income Benefit is provided under rider form series LDA-P-6054 and state variations thereof. Product availability and features may vary by state.

Protective Dimensions V variable annuity is a flexible premium deferred variable and fixed annuity contracts issued under policy form numbers VDA-P-2006 (PLICO). SecurePay Income benefits issued on rider form VDA-P-6068. Product availability and features may vary by state.

Variable annuities are long-term investments intended for retirement planning and involve market risk and the possible loss of principal. Investments in variable annuities are subject to fees and charges from the insurance company and the investment managers.

Investors should carefully consider the investment objectives, risks, charges, and expenses of a variable annuity, any optional protected lifetime income benefit, and the underlying investment options before investing. This and other information is contained in the prospectus for a variable annuity and its underlying investment options. Investors should read the prospectus carefully before investing. Prospectuses may be obtained by contacting Protective at 800-456-6330.

WEB.3143471.11.22

Protective Income Creator fixed annuity is a fixed, single premium, deferred annuity contract with a limited market value adjustment issued under contract form series LDA-P-2013 and state variations thereof. The Lifetime Income Benefit is provided under rider form series LDA-P-6054 and state variations thereof. Product availability and features may vary by state.

Protective Dimensions V variable annuity is a flexible premium deferred variable and fixed annuity contracts issued under policy form numbers VDA-P-2006 (PLICO). SecurePay Income benefits issued on rider form VDA-P-6068. Product availability and features may vary by state.

Variable annuities are long-term investments intended for retirement planning and involve market risk and the possible loss of principal. Investments in variable annuities are subject to fees and charges from the insurance company and the investment managers.

Investors should carefully consider the investment objectives, risks, charges, and expenses of a variable annuity, any optional protected lifetime income benefit, and the underlying investment options before investing. This and other information is contained in the prospectus for a variable annuity and its underlying investment options. Investors should read the prospectus carefully before investing. Prospectuses may be obtained by contacting Protective at 800-456-6330.

WEB.3143471.11.22

To exercise your privacy choices,

To exercise your privacy choices,