Withdrawal rate increase for the SecurePay IncomeSM benefit

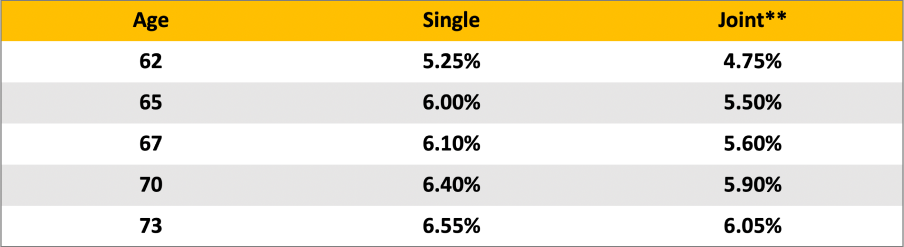

For stronger retirement income potential, we're increasing the guaranteed lifetime income withdrawal percentages at all ages — including a 6.00% increase at age 65.

Here's a look at the new SecurePay Income benefit guaranteed maximum annual withdrawal percentages at key ages.*

*For guaranteed lifetime income percentages for every age see the Product Comparison GridOpens in a new tab.

**The maximum withdrawal percentage is based on the age of the younger joint-covered person

Investment lineup enhancements

To optimize your clients' growth opportunity, we're also expanding the competitive investment lineup available with Protective Dimensions V variable annuity. We're adding three new fund managers — American Century, Janus Henderson and MFS — and 25 new funds, increasing the lineup to 104 investment options.

Here's a complete list of the new investment options.

- American Century VP Balanced

- American Century VP Disciplined Core Val

- American Century VP International I

- American Century VP Ultra® Fund

- BlackRock Advantage SMID Cap V.I. Fd III

- Goldman Sachs VIT Mid Cap Value Svc

- Invesco V.I. Main Street Mid Cap Fund - Series II

- Janus Henderson VIT Balanced Portfolio

- Janus Henderson VIT Forty Portfolio

- Janus Henderson VIT Glbl Tech & Innvt Port

- Janus Henderson VIT Overseas Portfolio

- Janus Henderson VIT Enterprise Portfolio

- MFS® Growth Series

- MFS® VIT II Core Equity Portfolio

- MFS® VIT II International Growth Port

- MFS® VIT II International Intrs Val Port

- MFS® VIT II MA Investors Growth Stk Port

- MFS® VIT II Research International Port

- MFS® VIT III Blended Rsrch Sm Cp Eq Port

- MFS® VIT III Global Real Estate Port

- MFS® VIT III Mid Cap Value Portfolio

- MFS® Mid Cap Growth Series

- MFS® VIT New Discovery Series

- MFS® Total Return Series

- T. Rowe Price Mid-Cap Growth Portfolio

Transition rules

We'll increase the withdrawal rates for the SecurePay Income benefit available on Protective Dimensions V variable annuity for new sales effective November 20, 2023.

- Tickets/applications dated November 19, 2023, or earlier and received in good order will be issued with the current withdrawal rates:

- Cash/applications/any 1035 exchange paperwork related to these new tickets/applications must be received no later than December 5, 2023 (10 business days from effective date).

- Previously submitted annuity tickets/applications that are awaiting funding from 1035 exchanges and/or not in good order (NIGO) items will continue to be processed through existing procedures.

- Tickets/applications for the Protective Dimensions V variable annuity dated November 20, 2023, and after will be accepted and issued with the new withdrawal rates.

To learn more about Protective Dimensions V variable annuity, visit our dedicated product page. If you have any questions, please contact your National Account Manager

Protective Dimensions V variable annuity is a flexible premium deferred variable and fixed annuity contract issued by PLICO in all states except New York on policy form VDA-P-2006. SecurePay Income benefit issued on rider form VDA-P-6068. SecurePay Nursing Home benefits issued under form number IPV-2159. Policy form numbers, product availability and features may vary by state.

Variable annuities are long-term investments intended for retirement planning and involve market risk and the possible loss of principal. Investments in variable annuities are subject to fees and changes from the insurance company and the investment managers.

Withdrawals reduce the annuity's remaining death benefit, contract value, cash surrender value and future earnings. Withdrawals may be subject to income tax and, if taken prior to age 59½, an additional 10% IRS tax penalty may apply. More frequent withdrawals may reduce earnings more than annual withdrawals. During the withdrawal charge period, withdrawals in excess of the penalty-free amount may be subject to a withdrawal charge.

Investors should carefully consider the investment objectives, risks, charges and expenses of a variable annuity, any optional protected lifetime income benefit, and the underlying investment options before investing. This and other information is contained in the prospectuses for a variable annuity and its underlying investment options. Investors should read the prospectuses carefully before investing. Prospectuses may be obtained by contacting PLICO at 800-456-6330.

WEB.5076430.08.23

To exercise your privacy choices,

To exercise your privacy choices,