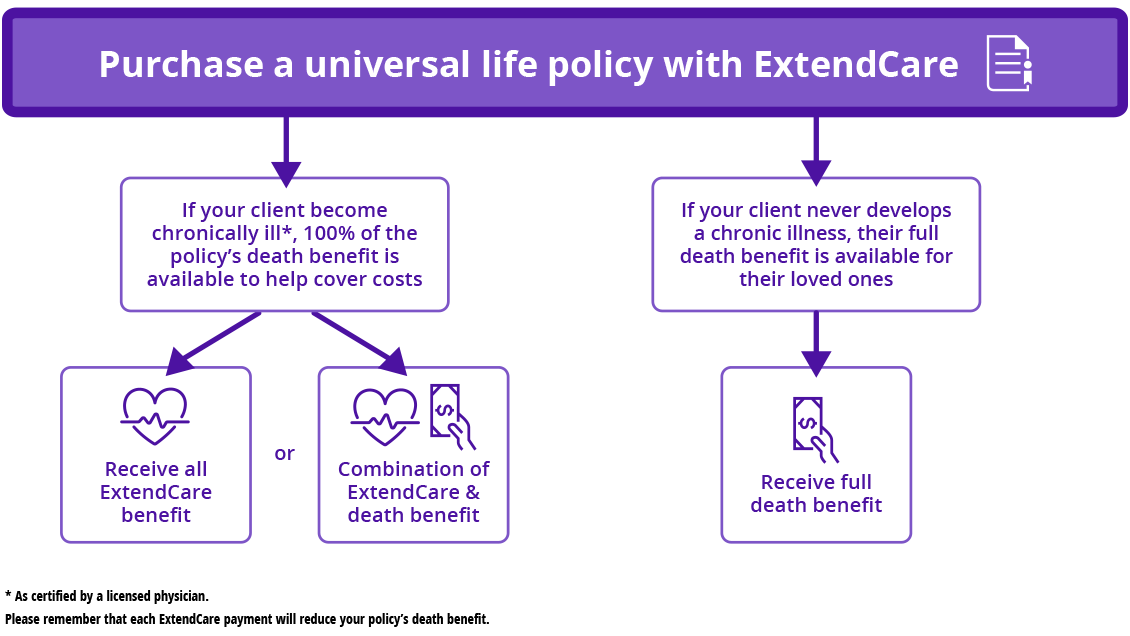

Preparing your clients for the unexpected goes beyond purchasing a policy that only offers death benefit protection. With our ExtendCare rider, they can advance their death benefit to manage the costs associated with a chronic illness.

Why should clients add the ExtendCare rider?

An unexpected chronic illness can create extra financial stress for clients. The ExtendCare rider can offer more security when it's needed most.

Find the right client fit for ExtendCare

When you meet with clients, you want to offer protection strategies that meet their needs. Here are some client profiles that may be best served with ExtendCare.

Pre-retiree protector

Career peak protector

Estate protector

Helpful resources

Use these resources to learn more about our ExtendCare rider and support your client conversations.

Review key rider details and specs

Introduce clients to chronic illness solutions

Get answers to common questions

Other related topics

Give clients flexible access to paid premiums with Return of Premium endorsement

Give clients predictable guarantees with Protective%%®%% Lifetime Assurance UL

Key decisions in retirement planning

We’re here for you

We’re ready to help you deliver the protection and security your clients deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

WEB.5571800.03.24

To exercise your privacy choices,

To exercise your privacy choices,